|

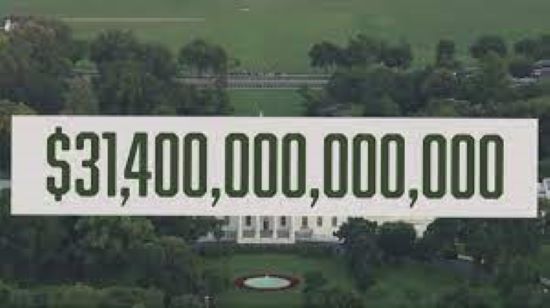

Last week the Senate voted to raise the federal debt ceiling, ending a political stalemate that had been going on for weeks. This week the House of Representatives followed suit by approving the debt ceiling measure, mostly along party lines. This self-imposed political crisis took the country and the financial markets on a needless roller coaster ride, but the drama is not over yet. The legislation “only” increases the debt ceiling by $480 billion, an amount the Treasury Department estimates will be enough for the federal government to pay its bills through December 3, 2021. What is the debt ceiling, and is it worth bringing the country close to financial calamity by partisans in Congress? The Debt Ceiling: Also known as the debt limit, it is a dollar amount set by Congress, of the maximum amount the Treasury can borrow to pay the financial obligations of the federal government. Congress has always restricted federal debt. But the debt ceiling was established in 1917 with the passage of the Second Liberty Bond Act to fund World War I, https://crsreports.congress.gov/product/pdf/RL/RL31967. This act allows the Treasury to borrow money, up to a set ceiling, in order to pay the government’s bills that have already been mandated by Congress. The debt ceiling has been raised dozens of times since 1917 by both Democrat and Republican administrations. It was increased three times during the Trump administration, each time requiring an act of Congress. The United States is one of only a few countries in the industrialized world to impose a debt ceiling. What Happens if the Debt Ceiling Isn’t Raised? The debt ceiling has never caused the federal government to default on its financial obligations. Afterall, the Congress has already approved the spending, and it has the authority to allow the Treasury to borrow the money to meet those obligations. But when federal borrowing gets close to the debt ceiling and Congress doesn’t approve more borrowing, there could be serious consequences to individuals, financial markets, and the economy. The federal government has been running budget deficits for years, and will continue to do so well into the future. Without the ability to borrow more money to fill the shortfalls, the government would default on its financial obligations. If this happens the Treasury would have to prioritize its spending. This could result in delayed Social Security checks to seniors and cuts to social programs, creating real hardships for people. If the United States were unable to make interest payments on its existing debt, the value of the dollar would decline, the costs of future borrowing would increase, financial markets around the world would tank, and it would probably throw the economy into recession. If the consequences of a default are so catastrophic, why throw up roadblocks which prevent the Treasury from doing its job? In a word, politics. Problems With the Debt Ceiling: The debt ceiling allows the Congress to maintain control over federal spending while providing the Treasury Department the ability to raise money when taxes and other inflows are insufficient to meet the government’s current obligations. The problems arise when the federal debt comes close to the debt ceiling limit and needs to be raised. This is the case that the government finds itself in today. Without the recently passed increase to the debt ceiling, the Treasury would not have been able to pay all of the government’s bills beyond October 18, 2021. This created huge uncertainties in financial markets and needlessly hindered the Treasury Department’s operations. The law requires that the government’s financial obligations be paid, but the debt ceiling could prevent the Treasury from issuing the debt needed to do so on time. The debt ceiling is an arbitrary value with no economic justification, based purely on the whims of Congress. More importantly, it does nothing to control federal spending since the spending has already been approved by Congress. If Congress actually wants to control spending it can do so through the federal budget and appropriations process. Over the past few weeks, the country has once again witnessed the real problem with the federal debt ceiling. It has become a political weapon to gain partisan advantage in Congress, particularly during budget negotiations. Until late last week the Republicans in the Senate threatened to withhold support for the bill to increase the federal debt ceiling. This was an effort to force President Biden to scale down his massive social spending program. The debt ceiling increase supported by the Republicans, will only allow the federal government to pay all of its bills through about December 3, 2021. So, in a few short weeks the partisan wrangling over the debt ceiling will begin anew. But GOP leader Mitch McConnel promises not to be so accommodating to the Democrats the next time. The political tensions will no doubt bring the country once again to the edge of fiscal default. It’s time to do away with this madness. Do Away with the Debt Ceiling: It would take an act of Congress to do away with the debt ceiling, and some on Capitol Hill are pushing for that to happen. Treasury Secretary Janet Yellen has recently testified in congressional hearings that she is in favor of eliminating the debt ceiling altogether. As the head of the Treasury and former head of the Federal Reserve, she has seen first hand how disruptive and potentially dangerous the political wrangling over raising the debt ceiling has become. Ms. Yellen makes the point that Congress already makes the decisions on taxes and spending, and must provide the Treasury the means to pay the obligations that they have approved, without further political interference. Paying our federal debts should be an automatic act, not subject to the whims of political brinksmanship. The debt ceiling doesn’t control federal spending, and needlessly burdens Congress with legislation when their time is needed for much more urgent matters. It often brings the Congress to a standstill and prevents the Treasury from performing its functions efficiently. It’s time for the United States to join most other industrialized countries and abolish the federal debt ceiling altogether. On May 20, 2021 a group of Democrat lawmakers introduced legislation to repeal the federal debt ceiling, https://foster.house.gov/media/press-releases/foster-schatz-bennet-van-hollen-introduce-legislation-to-repeal-debt-ceiling. In the press release announcing the legislation, the lawmakers state, “For too long, the debt ceiling has been weaponized during budget negotiations, creating the potential for massive disruptions to America’s financial system that would have drastic consequences for the worldwide economy”. I couldn’t agree more. The recurring fight over raising the debt ceiling is a manufactured political crisis. Let’s remove it as a partisan political weapon by getting behind this legislation. If you agree, contact your Congress member and let them know that it’s time to do away with the federal debt ceiling. If you enjoy reading this type of commentary please subscribe to my blog and tell a friend. You will receive an email notification when new blogs are posted. The email will come from the site’s email: armchairamerican1776 @gmail.com.

Thanks, Armchair American

0 Comments

Leave a Reply. |

AuthorThe Armchair American. Archives

November 2024

Categories

All

|

RSS Feed

RSS Feed