|

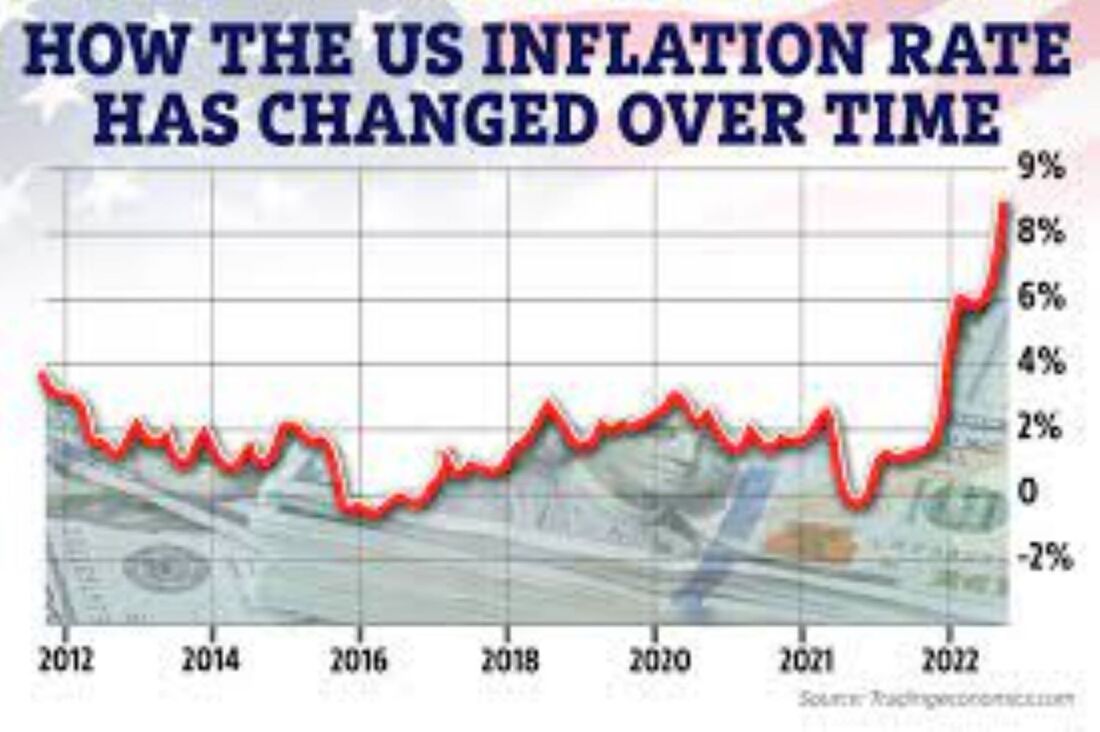

Summer is here, the kids are out of school, and our attention turns to fun in the sun and family vacations. This is the time of the year when the weighty issues of the day are put aside in favor of leisure pursuits. But this summer seems different. The country is in a funk. So, what is going on? COVID numbers are rising again, the war in Ukraine rages on, the stock market is in bear territory, the January 6th subcommittee reminds us daily how fragile our democracy is, and the Supreme Court has just delivered consequential decisions on abortion, gun rights, and the separation of church and state. But the real culprit behind all the unease is inflation! Inflation-2022 Style: It seems as if the prices on everything have gone through the roof this year. Price increases in grocery stores and at the gas pump have been particularly painful. The annual inflation rate, as measured by the Consumer Price Index, increased to 8.6% in May, https://www.bls.gov/cpi/. This is the highest rate since December of 1981. Food prices have increased overall by 10.1%, and even higher for meat, poultry, fish, and eggs. Overall energy costs have surged at an annual rate of 30.3%, mostly due to gasoline prices which have climbed 48.7%. Inflation has significantly outpaced the wage gains of recent years, putting a real dent in household budgets. The inflationary period we are in, more than anything else, is on the minds of most Americans. Econ 101: Economists have sophisticated inflation models which take into account various supply and demand components, employment data, and the money supply. In simple terms, prices generally rise when consumers and businesses demand more goods and services than companies are able, or willing to supply. Normally when demand increases, the supply quickly ramps up to meet the demand, thereby dampening the upward pressure on prices. But these are not normal times, and the economic models can’t explain how inflation shot up from around 2% before the pandemic to 8.6% in May. How Did We Get Here: In a nutshell, today’s inflation is due to the COVID-19 pandemic, the Federal Government’s response to it, and the Russian invasion of Ukraine. Let’s look at each of these three issues separately. COVID-19 Pandemic: In the winter and spring of 2020 the world began to shut down, and international borders were closed to travelers and commerce. In the United States, stay-at-home orders were put into place, schools closed, and many “non-essential” businesses were shut down. As a result, millions of people lost their jobs and many small businesses were closed.

Government’s Response to Pandemic: In March of 2020 the Federal Reserve cut interest rates to keep the economy from slowing. That same month President Trump signed into law the $2 trillion CARES Act. Among other things this bill provided payments to all Americans, expanded unemployment benefits, and provided direct payments to state and local governments. In March of 2021, President Biden signed into law the $1.9 trillion American Rescue Plan. This bill essentially doubled down on the CARES Act, providing additional stimulus to the U.S. economy. In all, the Federal Government enacted six major bills, pumping more than $5 trillion dollars into the economy during the pandemic https://ballotpedia.org/Overview_of_federal_spending_during_the_coronavirus_(COVID-19)_pandemic. There is still nearly $1 trillion not yet spent. There is no question that all of the government stimulus in response to the pandemic, particularly the American Rescue Plan coming the heels of the $3 trillion spent during the Trump administration, increased inflation. All of the money pumped into the U.S. economy artificially increased demand for goods and services of all types. This in turn increased the demand for workers, at a time when child care and COVID concerns kept many from reentering the workforce. The tight labor market increased wages, adding to inflationary pressures in all sectors of the economy. In a recently published paper, the Federal Reserve Bank of San Francisco estimates that the COVID spending bills in the U.S. raised inflation by about 3 percentage points by the end of 2021, https://www.frbsf.org/economic-research/publications/economic-letter/2022/march/why-is-us-inflation-higher-than-in-other-countries/. The paper goes on to state that other developed countries are not experiencing the same level of inflation as the United States because they pumped significantly less money into their economies during the pandemic. Time will tell which was the better approach. But in the short-term Americans are suffering. Russian Invasion of Ukraine: Russia is a major supplier of oil, gas, and metals. Along with Ukraine, it is also a major exporter of wheat and corn. The Russian invasion of Ukraine earlier this year disrupted the production and distribution of these key commodities. These supply disruptions, along with sanctions placed on Russian energy, have pushed energy and other commodity prices higher. The war has also made the shipment of grains from Black Sea ports next to impossible, so more expensive alternatives, including trucks and trains, are being used for transport. It is difficult to say just how much the war in Ukraine has impacted inflation rates in the United States. But there is no doubt that the war is constraining the supply of oil, thus keeping the price of oil and transportation fuels high in the United States. In addition to feeling the pain at the gas pump, consumers are hurt because higher transportation costs have pushed prices higher for food and other essential goods. What Can the Government do About Inflation? Taming inflation requires either reducing demand to meet supply or boosting supply to catch up to demand. This will occur naturally over an extended period of time. But this is an election year and Americans vote on pocket book issues. There are no greater pocket book issues today than grocery and gas prices. The Federal Reserve has already moved to moderate inflation, and the Biden Administration is under tremendous pressure to do something. Federal Reserve Policy: The Federal Reserve has a mandate to maintain price stability and to keep the inflation rate at about 2%. Its main tool to lower inflation is by increasing interest rates. Higher interest rates lead to increased mortgage rates, as well as other consumer and business borrowing costs. Higher borrowing costs generally lead to lower demand, particularly for large ticket items such as autos and houses. Overtime the lower demand will allow prices to come down and stabilize. Last week the Federal reserve increased interest rates by 0.75 percentage points, the largest incremental increase since 1994. This had the impact of pushing the 30-year mortgage rate to about 6%, compared to 3% a year earlier. Credit card and other consumer debt has become more expensive, which should lead to lower consumer spending. This of course is a balancing act. If the Federal Reserve is too aggressive in raising interest rates, the economy could go into recession. But if interest rates remain stubbornly high, consumer purchasing power will continue to erode. Biden Administration: There is no magic bullet or policy prescription for the Biden Administration to lower the rate of inflation. The administration could decrease excess demand by moderating its spending. It could also decrease demand by increasing taxes on individuals and corporations. Since cutting spending and increasing taxes aren’t politically popular, his best approach would be to help increase of the supply of goods constrained by the pandemic and the war in Ukraine.

As long as prices remain high in the grocery stores and gas stations, we will all be singing the summertime blues. Gas prices will come down naturally when the summer driving season ends and demand for gas drops. The Biden Administration has the power to curve its spending and remove unused federal money from the economy to help lower demand. But it will rely on the Federal Reserve to do most of the heavy lifting. The Fed has pledged to keep increasing interest rates until it breaks the back of inflation. Let’s just hope that it doesn’t break the back of the economy.

If you enjoy reading this type of commentary please subscribe to my blog and tell a friend. You will receive an email notification when new blogs are posted. The email will come from the site’s email: armchairamerican1776 @gmail.com. Thanks, Armchair American

1 Comment

KELLY k LOPEZ

6/27/2022 09:31:09 am

Very informative. Thank you!

Reply

Leave a Reply. |

AuthorThe Armchair American. Archives

November 2024

Categories

All

|

RSS Feed

RSS Feed