|

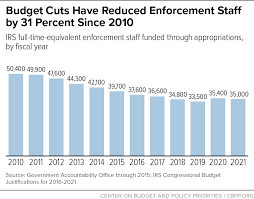

The 2021 tax filing season is coming to a close. So, it’s a good time to reflect on the most hated, but perhaps the most necessary federal agency, the Internal Revenue Service (IRS). I am a volunteer income tax preparer for the AARP Foundation Tax-Aide program, and prepare dozens of tax returns each year for seniors and low-income families. I witness first hand the frustrations people have dealing with the IRS, and the complexities and anxieties of complying with the U.S. tax code. The IRS deserves some of the credit for its negative image. It has been used as a political weapon by unscrupulous lawmakers, and incompetence has prevented it from becoming an efficient, well-run 21st century organization. But Congress deserves much of the credit for the IRS’s failings, through increased mandates and years of underfunding. Role of the IRS: The IRS is a bureau of the Department of the Treasury and is responsible for helping taxpayers understand and meet their tax obligations. Congress writes the tax laws, but it is up to the IRS to interpret, enact, and enforce these laws with integrity and fairness. This is not an easy lift, even in the best of times. The pandemic, staff shortages, and years of underfunding have made the work of the IRS even more difficult. What the IRS Gets Right: The IRS is a giant collection agency. It collects over 95% of all revenue coming into the Federal Treasury, nearly $4 trillion per year. In 2020 the IRS spent just 35 cents for each $100 it collected; not a bad return on investment (https://www.irs.gov/about-irs/the-agency-its-mission-and-statutory-authority). The IRS is also very good at sending out tens of millions of refund checks each year. In 2020 and 2021, during the worst pandemic in over one hundred years, the IRS managed to send out hundreds of millions of stimulus payments to most Americans, while still performing its other obligations. But the pandemic placed other strains on the IRS. It was required to send out Advanced Child Tax Credits to millions of families and administer more than a dozen other COVID-relief programs. This has compounded the massive backlog at the IRS. The IRS is Drowning in Paper: According to the National Taxpayer Advocate, Erin Collins, “Paper is the IRS’s Kryptonite, and the IRS is buried in it”. More than 90% of taxpayers file their taxes electronically. This represents a huge success for the IRS, but much more work needs to be done. Last year the IRS received more than 17 million paper returns from individuals, over 4 million amended returns in paper form, and millions more paper returns filed by businesses. Everyone of these paper returns must be keyed into a computer by an IRS employee. According to the National Taxpayer Advocate, last year there were transcription errors on about 22% of these returns. The end of the 2021 tax filing season is fast approaching and the IRS is still working on a backlog of nearly 15 million paper returns from 2020. This makes for a lot of unhappy taxpayers who have been waiting for more than a year for their tax refunds. What Congress Needs to Do to Help the IRS:

What the IRS Can Do to Help Itself:

What Taxpayers Can Do to Help Themselves and the IRS:

The U.S. Government expects so much from the IRS but doesn’t give it the tools to function as an efficient 21st century organization. The Government heavily leaned on the IRS to implement many of its COVID relief programs while still performing its primary tasks. All this was done as COVID restrictions and funding shortfalls crippled IRS staffing levels. I have only scratched the surface of the challenges facing the IRS. The agency is dealing with millions of cases of tax refund fraud due to ID theft, it generates and responds to millions of pieces of correspondence each year, and participates in many outreach and educational programs. No one wants an intrusive, burdensome IRS meddling into their financial lives. But for better or for worse, we need the IRS, and we need it to be run efficiently and administer the tax code fairly. We even need the IRS to step up enforcement, perform many more tax audits, and close the huge “tax gap” that goes uncollected each year. Yes folks, it’s time to show the IRS a little love, and remind our representatives in Congress that we expect them to do the same.

If you enjoy reading this type of commentary please subscribe to my blog and tell a friend. You will receive an email notification when new blogs are posted. The email will come from the site’s email: armchairamerican1776 @gmail.com. Thanks, Armchair American

0 Comments

Leave a Reply. |

AuthorThe Armchair American. Archives

November 2024

Categories

All

|

RSS Feed

RSS Feed